In the world of trading, understanding and using key levels is crucial for success in financial markets. Key levels, also known as support and resistance levels, play a fundamental role in making trading decisions. This article will explore in detail what key levels are, how to identify them, their applications in trading, and the lessons we can learn from this strategy.

What are Key Levels?

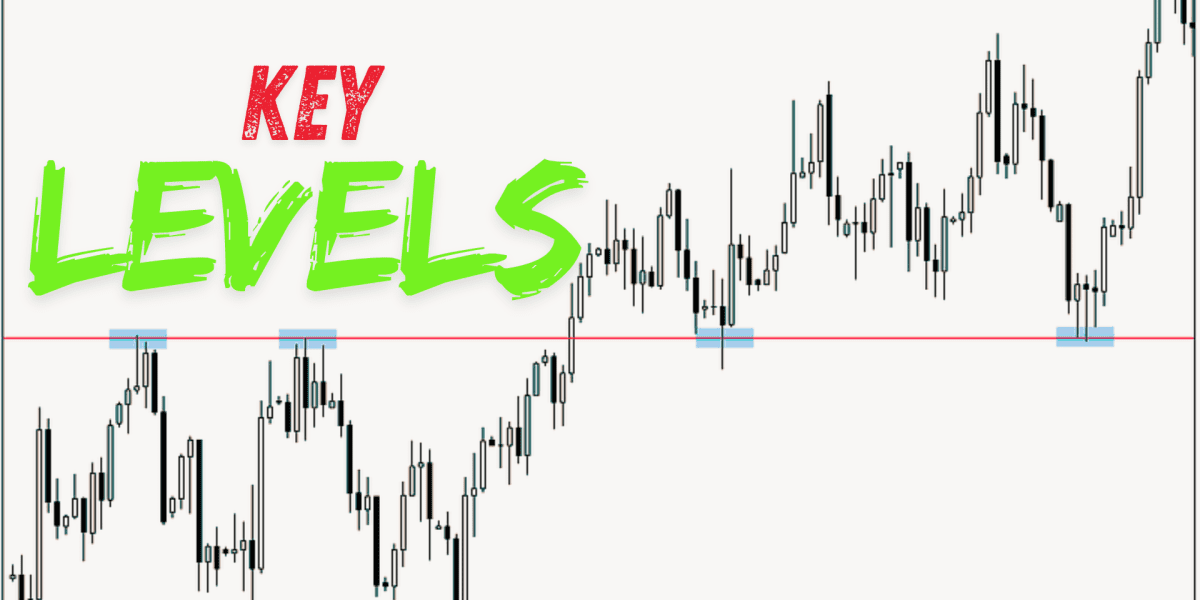

Key levels are areas on a price chart where price action tends to react. They represent zones where supply and demand meet, often causing trend reversals or consolidations. These levels can act as natural barriers for price movement, preventing prices from rising or falling beyond a certain point.

Identifying Key Levels

Identifying key levels requires a combination of analytical skills and practice. Here are some common methods to spot these levels:

- Price History: Levels where prices have frequently bounced or been rejected in the past are often considered key levels.

- Moving Averages: Significant moving averages, such as the 50-day or 200-day moving average, can act as support or resistance levels.

- Pivot Points: Used mainly by day traders, pivot points are levels calculated using the highs, lows, and closes of previous days.

Application of Key Levels in Trading

Key levels are used in various aspects of trading, including:

- Determining Entry and Exit Points: Traders look to enter the market when prices bounce off a support level or sell when prices are rejected by a resistance level.

- Setting Stop-Loss and Take-Profit Orders: Key levels help place stop-loss orders just below support levels or above resistance levels to minimize losses.

- Identifying Trend Breakouts: A breakout above or below a key level can indicate the start of a new trend.

Case Studies and Practical Examples

To illustrate the importance of key levels, let’s examine some practical examples:

- Support Example: On an EUR/USD chart, the 1.1000 level acted multiple times as support, where prices bounced each time they reached this level.

2. Resistance Example: On an S&P 500 chart, the 3000 level served as strong resistance, where prices struggled to break through this level multiple times.

Trading Lessons on Key Levels

- Patience and Discipline: Waiting for prices to reach a key level before taking a position can increase the chances of success.

- Using Confirmation Tools: Using other technical indicators to confirm the importance of a key level can improve trade accuracy.

- Flexibility: Key levels can evolve over time. It’s important to regularly reassess charts to adjust these levels based on market developments.

Contributions and Legacy of Key Levels

Key levels have been used by many legendary traders and continue to be a cornerstone of modern technical analysis. They provide a solid foundation for understanding market dynamics and take into account the psychological behaviors of traders.

Conclusion

Key levels are undoubtedly one of the most essential and effective strategies in trading. Their ability to indicate potential reversal points and provide clear benchmarks for risk management makes them an indispensable tool for any serious trader. By understanding and correctly applying key levels, traders can significantly improve their performance in financial markets.