Introduction

The Harmonic trading strategy is an advanced technical analysis method that relies on identifying specific patterns in price movements based on Fibonacci ratios. This unique approach allows traders to anticipate trend reversals with high precision. This article explores the Harmonic strategy in depth, its origins, key patterns, how to use them, and the pros and cons of this method.

What is the Harmonic Trading Strategy?

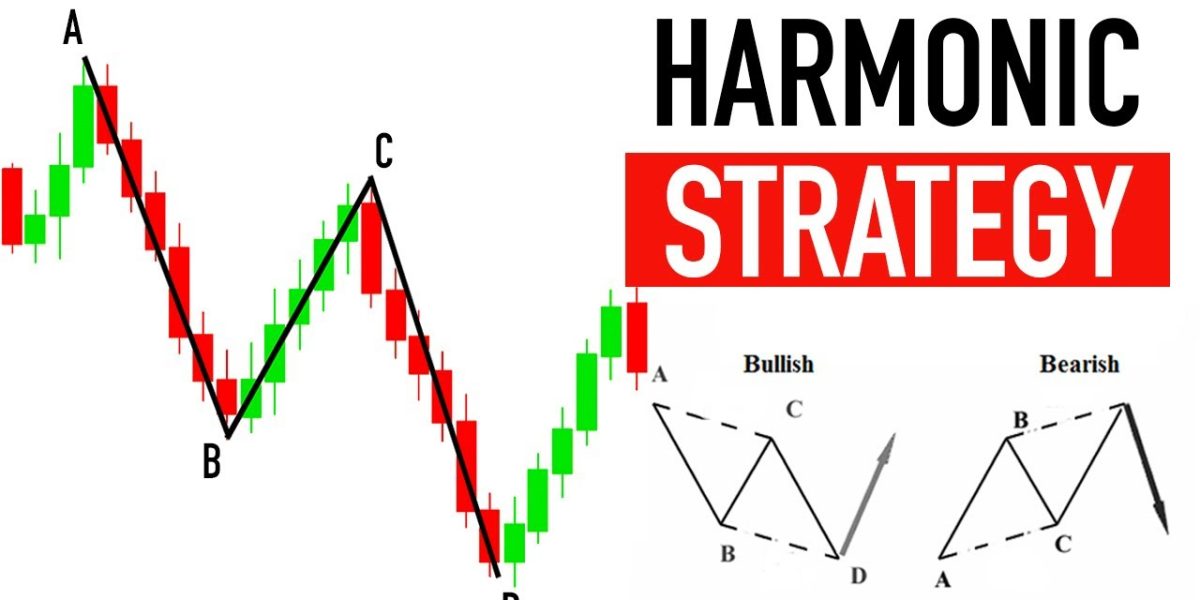

The Harmonic strategy is based on the idea that markets move in repetitive and predictable patterns. These patterns, known as “Harmonic patterns,” are constructed using specific Fibonacci ratios. One of the fundamental principles of this strategy is that markets are influenced by natural cycles that can be predicted using these patterns.

Key Harmonic Patterns

Several Harmonic patterns are used by traders to anticipate market movements. Here are the most common ones:

- Gartley: A pattern consisting of five points (X, A, B, C, D) that identifies a potential trend reversal.

- Butterfly: A pattern similar to the Gartley but with deeper extensions, often indicating the end of a trend.

- Bat: A pattern similar to the Gartley but with a lower point B, offering a better risk-reward opportunity.

- Crab: A pattern with a wider extension than the Butterfly, often associated with highly volatile market reversals.

How to Use the Harmonic Strategy

- Pattern Identification: The first step is identifying a potential Harmonic pattern on the chart. This requires a good understanding of Fibonacci ratios and the ability to recognize specific configurations.

- Confirmation with Fibonacci: Once a pattern is identified, use Fibonacci ratios to confirm its validity. Key levels include 61.8%, 78.6%, and 88.6%.

- Order Placement: Entry, stop-loss, and take-profit points are usually placed at specific levels defined by the pattern. For example, a buy order might be placed at point D of a Gartley pattern, with a stop-loss below point X.

- Risk Management: As with any trading strategy, risk management is crucial. It’s important to adhere to stop-loss levels and avoid over-leveraging your position.

Pros and Cons of the Harmonic Strategy

Pros:

- Precision Entries: Harmonic patterns allow for very precise entries, often at key reversal levels.

- Structured Framework: This strategy provides a structured framework for trading, with clear rules based on Fibonacci ratios.

- Multi-Market Application: Harmonic patterns can be applied across different markets, including stocks, currencies, and commodities.

Cons:

- Complexity: The Harmonic strategy is complex and requires a solid understanding of Fibonacci ratios and patterns.

- Rarity of Opportunities: Harmonic patterns do not form frequently, which can limit the number of trading opportunities.

- Dependence on Tools: Many traders use specific software to identify patterns, which can be a drawback for those who prefer a more manual approach.

Real-World Examples

To illustrate the effectiveness of the Harmonic strategy, consider the Gartley pattern on a currency pair like EUR/USD:

- Gartley Pattern: A Gartley pattern forms on the daily chart of EUR/USD. The D point, near the 78.6% Fibonacci retracement level, offers a buying opportunity.

- Outcome: The price rebounds strongly from the D point, reaching the anticipated take-profit level, demonstrating an excellent risk-reward ratio.

Conclusion

The Harmonic trading strategy is a powerful tool for advanced traders seeking to capitalize on market reversals with precision. While it requires a deep understanding of patterns and Fibonacci ratios, it offers a structured framework and high-potential trading opportunities. For